What is a buyer’s credit?

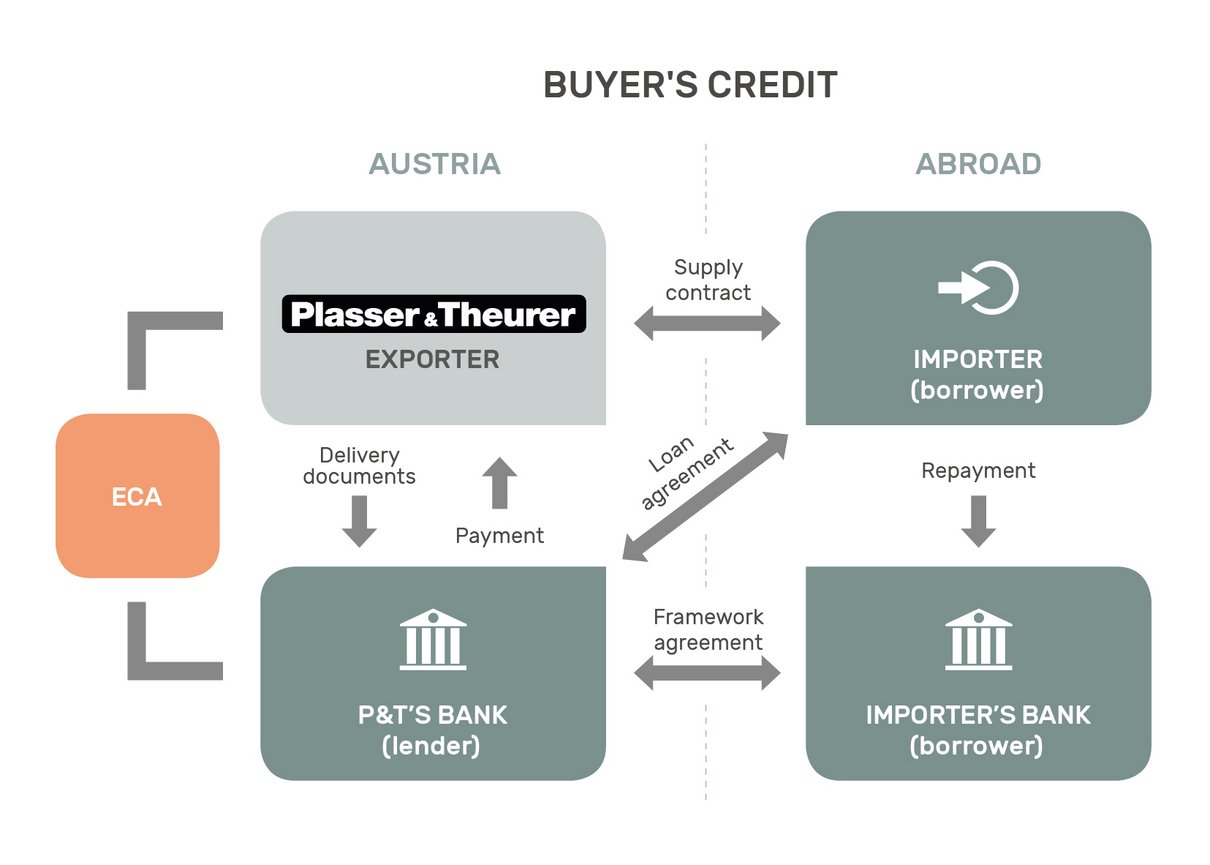

A buyer’s credit is a financing alternative for cross-border transactions. It is tied to the supply contract between Plasser & Theurer (the exporter) and the customer (the importer). We act as a financial intermediary.

The terms of a buyer’s credit are set forth either in an individual loan agreement or as part of an existing framework agreement. There are two options for concluding an individual loan agreement: either it is between Plasser & Theurer’s bank and the importer directly or between Plasser & Theurer’s bank and the importer’s bank. In the case of an existing framework agreement, the two banks conclude the loan agreement.