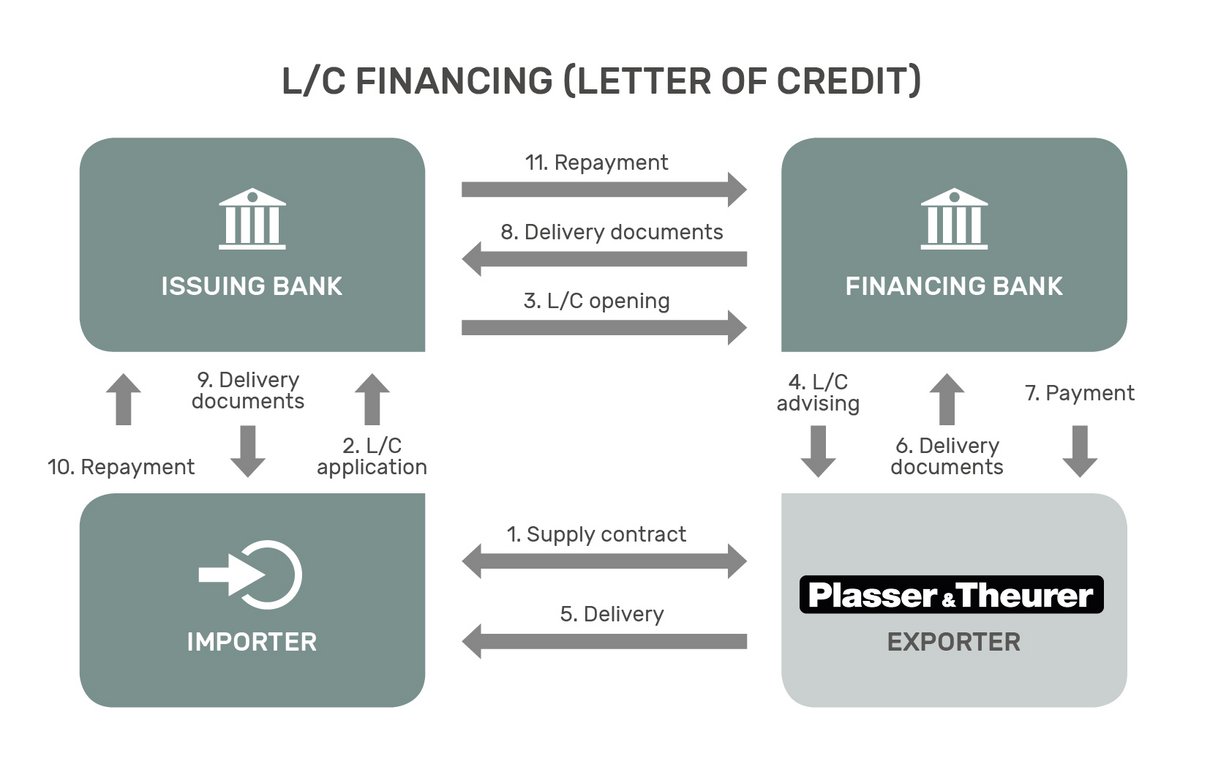

What is L/C financing?

A letter of credit (L/C) is an internationally recognised payment and hedging instrument. It is an integral part of the global trade finance scene. An L/C represents a bank's abstract obligation to pay the exporter, named in the L/C as the beneficiary, upon presentation of the conforming documents. The L/C also serves as a guarantee for the importer: the exporter only receives payment after proving they have met their obligations (for example, machine delivery).